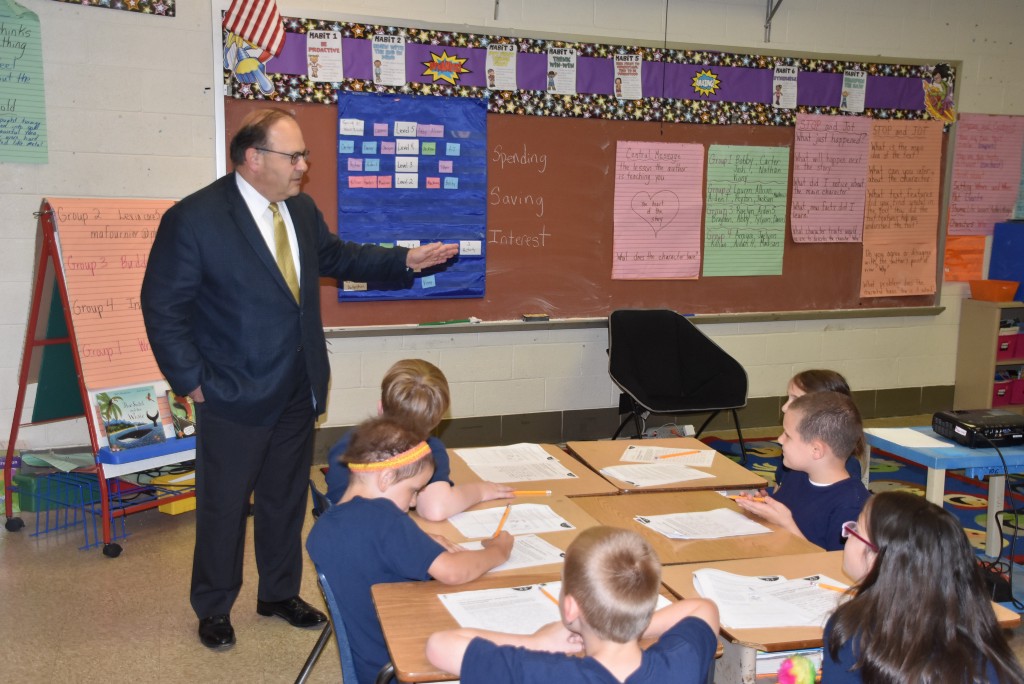

City Councilman Allan Domb speaks to students at Hancock about their financial literacy classes.

It’s never too early in life to learn the importance of money. Students at Hancock Elementary, 3700 Morrell Ave., are learning this valuable lesson and becoming financially literate in the process.

Last year, City Councilman Allan Domb heard about a unique program that the Federal Reserve Bank of Philadelphia was leading.

The Federal Reserve Bank, the Philadelphia Higher Education Network for Neighborhood Development, TD Bank and the Urban Affairs Coalition were giving teachers from the area a class in financial literacy that they could then bring into their own classrooms.

“We demonstrate the lessons as if they were the students, so they can actually see the lesson in action,” said Todd Zartman, economic education specialist with the Federal Reserve Bank.

The teachers are provided handouts from the Federal Reserve coupled with some outside material to bring into their classrooms.

Domb heard about the success that these teachers were experiencing and questioned, “How can we spread that to the (Philadelphia) public school system?”

Teachers from grades K-12 who were attending this class at the Federal Reserve were going on their own time and dime, so Domb thought a way to promote teacher attendance would be to compensate them at their contractually negotiated rate for professional development, $29.45 per hour for those in the Philadelphia public school system. Domb also offered a $40 stipend for preschool teachers who were interested in the one time training at the Federal Reserve, known as “Kiddynomics Training”, whether they were public, private or parochial.

A number of schools in the Northeast and beyond jumped on the opportunity provided by Domb and the Federal Reserve, but one school particularly has stood out to the councilman.

“Hancock has embraced it the most,” said Domb.

Thus far, Domb has compensated over 60 Philadelphia teachers ranging from grades Pre-K through 12th to partake in the financial literacy training course. At Hancock, there are 18 classes, including all classes grades K-5, that are currently using the lessons provided from the financial literacy courses.

When approached about the possibility of the staff at Hancock participating in these lessons, assistant principal Andrea Miller thought it was so pivotal that she even wanted to attend a one-day course.

“I think topdown has to really invest in it,” Miller said. “I went for the training, I was a part of it, we’re in this together, it isn’t just like, ‘Here do this.’ ”

During one day last summer, eight teachers from Hancock’s kindergarten through second grade went to the Federal Reserve for the class. The rest of the teachers from third through fifth grades attended a one-day class on Jan. 2.

Each grade and teacher has gone their own way about implementing this unique program. Some grades do the lessons together as a whole, while some teachers prefer to teach it within their own classroom.

The one constant in these exercises is the outstanding student engagement, according to third-grade teacher Antonella Gramaglia.

“I thought at this age level it would really interest them and they love it,” Gramaglia said. “‘Cause a lot of things they do not understand, they just know, ‘Give me money,’ and then that’s about it.”

Students in her classroom have formed groups in which they learn about the costs of starting their own businesses coupled with the importance of how to adequately promote their brand.

“Being exposed now gets them thinking,” Gramaglia said.

While students and faculty alike at Hancock have bought into the first year of this program, Domb believes this needs to be a citywide effort to combat poverty.

“We have 88 percent of our children in public schools in poverty,” Domb stated. “Ninety-one percent have one parent.”

Domb also cited Philadelphia’s poverty rate being at “about 26 percent.”

“One of our goals is to change the level of poverty in the city and its generational poverty,” Domb said. “And one of the best tools of changing that is through financial literacy pre-K to 12th grade. It’s not going to happen overnight, but over the next 10–15–20 years, by teaching financial literacy, we will break generational poverty.”

It appears that Hancock has provided the blueprint for other public schools to follow for financial literacy. The one certainty that Domb believes is that this can work in each school across the city. ••

John Cole can be reached at [email protected]